Save It 2 Spend It – Budgeting 101

CAN WE AFFORD IT?

How many times have you asked yourself that in the last year, or month, or if you are anything like me, in the last day! Save It 2 Spend It – Budgeting 101!! Sometimes the answer is easy, sometimes it is much more complex. Everyone has a different financial and emotional threshold of what is “worth” our spending. There is no right or wrong here (unless you are trying to make the champagne taste on a beer budget lifestyle work).

If I had to make one suggestion to anyone trying to gain financial stability it would be this- Do not spend what you don’t have! Credit cards are fine if you can pay them off every month. DO NOT spend more than you can pay off. If you are low on cash, the last thing you want to do is accrue more debt by owing the creditor’s interest! I understand that things come up which sometimes require the use of credit cards to pay for but if you are wearing Prada and paying for rounds at the bar every Friday night and carrying a balance month to month, please stop!

See, I was the 21-year-old girl paying for rounds at the bar, paying for fast food, paying for new clothes, road trips, etc. Not a cent of savings to my name and a credit card balance that was going up monthly. It was not a good feeling. I was working as a waitress, so my income was extremely varied month to month. I knew very little about how savings worked and honestly didn’t much care. My only goal was to ensure that I had enough money at the end of my month to pay my rent/bills and minimum payments on my credit cards.

Now as a **cough**cough** 40-year-old** cough** woman I am constantly surprised to see how many people, younger and older, are still lost when it comes to savings. Years ago when my husband was out of work we were forced to bunker down and really watch our finances. In my mind, looking at my paycheck and our bills it seemed like we should have enough. However, month after month we were in the red.

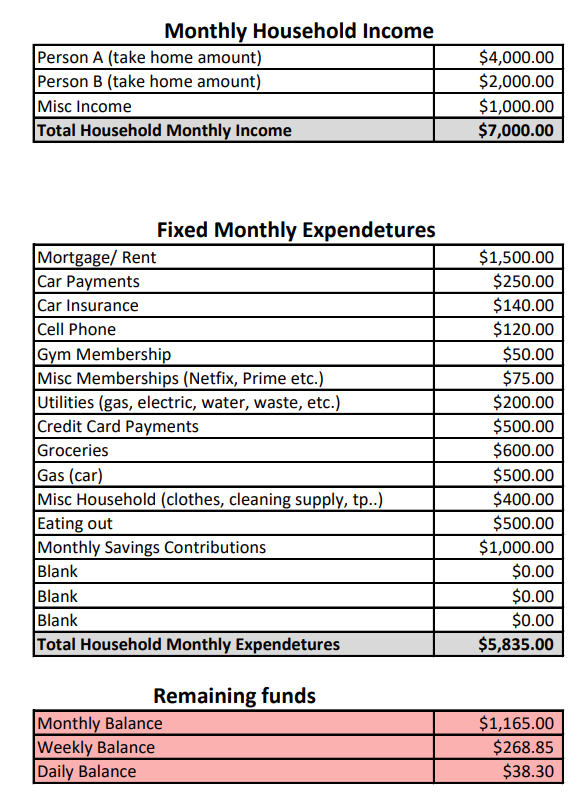

I tried the envelope method of setting up envelopes with x dollars for food, x for spending, x for rent, etc… Coming up with the cash to establish the envelopes in the first place was very hard at the time. So instead, I decided to create a sort of virtual envelope system in the form of a simple editable budget.

I have been using this budget occasionally for the last 13 years. The numbers change, the expense categories change but the principle is the same always. Money in vs money out. This has helped us increase our savings contributions considerably. By looking at your fixed bills monthly it allows you to see what areas you are bleeding unnecessarily.

HOW DO I START?

The first step is to download all of your spending reports for the last 2 or 3 months. You can get them in excel form from your bank and credit card companies. Once you have them highlight any fixed monthly expenses (as outlined in my budget). Also, note all incomes which will also go into the budget.

Once you have those numbers you can start plugging them into the spreadsheet. Once you have entered all of the fixed charges, notice how much money you have remaining. From there, start looking at the variable amounts (eating out, groceries, memberships, TARGET shopping, AMAZON bills). Although these categories cannot be completely cut out, there are ways to trim them down, I guarantee!

Now once you have all those numbers in look at your over-under. If you are in the red, this is where you will need to start making some changes. If you are left with money, this is where savings comes in.

WHAT DO I DO IF I AM IN THE RED

If you are in the red, you need to take a good long look at where exactly your money is going. For us, we noticed a trend in Convenience Store purchases. When you travel for work and are on the road a lot, $5-$10 on an energy drink and bag of chips may not seem like much. However, when you times that by 5 days a weekend 52 weeks a year it really adds up! Also, I noticed a big issue in my Target trips. I would go for deodorant and come home with $100 worth of things I didn’t need.

Search your bank and credit card statements for transactions like this. Most likely you will easily identify your spending weakness.

Once identified, it’s up to you to come up with a solution. For us, we focused on preparing for the drives. We packed food for the day as well as road snacks for the commute home. For Target, I now utilize online ordering or curb-side pickup. By doing this, impulse buying is limited.

WHAT DO I DO WITH THE EXCESS MONEY

For the next part, there are two roads you can take:

Instance A – You have Credit Card debt.

In this case, you should try to put a small amount (really anything is better than nothing $10-$20) into savings. THE REST should go straight to your credit card balances. Look at your terms, pay off the highest interest rate first!

Instance B – You have no Credit Card debt.

AUTOMATIC SAVINGS CONTRIBUTIONS ARE YOUR FRIEND!

GO, NOW, SET AT LEAST ONE UP! Whatever money is left on your budget should all be going into savings!! Why not, worst-case scenario you will need to pull some back out! The best case and likely scenario is that even if you have to pull some out. With enough regular contributions, over time your balance will inevitably grow.

Using this method allows you, over time, to not rely on those credit cards for large expenses. Your savings account becomes your safety net. It also allows you to answer the question posed at the start of this article – Can we afford it?

I use this budget every time we consider a large purchase or home improvement endeavor.

This budget has helped several of my friends since its creation and I am hopeful that it will help you.